-

Capacitors

- Ceramic Capacitors

- Tantalum Capacitors

- Accessories

- Aluminum - Polymer Capacitors

- Aluminum Electrolytic Capacitors

- Capacitor Networks, Arrays

- Electric Double Layer Capacitors (EDLC), Supercapacitors

- Film Capacitors

- Mica and PTFE Capacitors

- Niobium Oxide Capacitors

- Silicon Capacitors

- Tantalum - Polymer Capacitors

- Thin Film Capacitors

- Trimmers, Variable Capacitors

-

Discrete Semiconductor Products

- Diodes - Bridge Rectifiers

- Diodes - Rectifiers - Arrays

- Diodes - Rectifiers - Single

- Diodes - RF

- Diodes - Variable Capacitance (Varicaps, Varactors)

- Diodes - Zener - Arrays

- Diodes - Zener - Single

- Power Driver Modules

- Thyristors - DIACs, SIDACs

- Thyristors - SCRs

- Thyristors - SCRs - Modules

- Thyristors - TRIACs

- Transistors - Bipolar (BJT) - Arrays

- Transistors - Bipolar (BJT) - Arrays, Pre-Biased

- Transistors - Bipolar (BJT) - RF

- Transistors - Bipolar (BJT) - Single

- Transistors - Bipolar (BJT) - Single, Pre-Biased

- Transistors - FETs, MOSFETs - Arrays

- Transistors - FETs, MOSFETs - RF

- Transistors - FETs, MOSFETs - Single

- Transistors - IGBTs - Arrays

- Transistors - IGBTs - Modules

- Transistors - IGBTs - Single

- Transistors - JFETs

- Transistors - Programmable Unijunction

- Transistors - Special Purpose

- Inductors, Coils, Chokes

-

Integrated Circuits (ICs)

- Audio Special Purpose

- Clock/Timing - Application Specific

- Clock/Timing - Clock Buffers, Drivers

- Clock/Timing - Clock Generators, PLLs, Frequency Synthesizers

- Clock/Timing - Delay Lines

- Clock/Timing - IC Batteries

- Clock/Timing - Programmable Timers and Oscillators

- Clock/Timing - Real Time Clocks

- Data Acquisition - ADCs/DACs - Special Purpose

- Data Acquisition - Analog Front End (AFE)

- Data Acquisition - Analog to Digital Converters (ADC)

- Data Acquisition - Digital Potentiometers

- Data Acquisition - Digital to Analog Converters (DAC)

- Data Acquisition - Touch Screen Controllers

- Embedded - CPLDs (Complex Programmable Logic Devices)

- Embedded - DSP (Digital Signal Processors)

- Embedded - FPGAs (Field Programmable Gate Array)

- Embedded - FPGAs (Field Programmable Gate Array) with Microcontrollers

- Embedded - Microcontroller or Microprocessor Modules

- Embedded - Microcontrollers

- Embedded - Microcontrollers - Application Specific

- Embedded - Microprocessors

- Embedded - PLDs (Programmable Logic Device)

- Embedded - System On Chip (SoC)

- Interface - Analog Switches - Special Purpose

- Interface - Analog Switches, Multiplexers, Demultiplexers

- Interface - CODECs

- Interface - Controllers

- Interface - Direct Digital Synthesis (DDS)

- Interface - Drivers, Receivers, Transceivers

- Interface - Encoders, Decoders, Converters

- Interface - Filters - Active

- Interface - I/O Expanders

- Interface - Modems - ICs and Modules

- Interface - Modules

- Interface - Sensor and Detector Interfaces

- Interface - Serializers, Deserializers

- Interface - Signal Buffers, Repeaters, Splitters

- Interface - Signal Terminators

- Interface - Specialized

- Interface - Telecom

- Interface - UARTs (Universal Asynchronous Receiver Transmitter)

- Interface - Voice Record and Playback

- Linear - Amplifiers - Audio

- Linear - Amplifiers - Instrumentation, OP Amps, Buffer Amps

- Linear - Amplifiers - Special Purpose

- Linear - Amplifiers - Video Amps and Modules

- Linear - Analog Multipliers, Dividers

- Linear - Comparators

- Linear - Video Processing

- Logic - Buffers, Drivers, Receivers, Transceivers

- Logic - Comparators

- Logic - Counters, Dividers

- Logic - FIFOs Memory

- Logic - Flip Flops

- Logic - Gates and Inverters

- Logic - Gates and Inverters - Multi-Function, Configurable

- Logic - Latches

- Logic - Multivibrators

- Logic - Parity Generators and Checkers

- Logic - Shift Registers

- Logic - Signal Switches, Multiplexers, Decoders

- Logic - Specialty Logic

- Logic - Translators, Level Shifters

- Logic - Universal Bus Functions

- Memory

- Memory - Batteries

- Memory - Configuration Proms for FPGAs

- Memory - Controllers

- PMIC - AC DC Converters, Offline Switchers

- PMIC - Battery Chargers

- PMIC - Battery Management

- PMIC - Current Regulation/Management

- PMIC - Display Drivers

- PMIC - Energy Metering

- PMIC - Full, Half-Bridge Drivers

- PMIC - Gate Drivers

- PMIC - Hot Swap Controllers

- PMIC - Laser Drivers

- PMIC - LED Drivers

- PMIC - Lighting, Ballast Controllers

- PMIC - Motor Drivers, Controllers

- PMIC - OR Controllers, Ideal Diodes

- PMIC - PFC (Power Factor Correction)

- PMIC - Power Distribution Switches, Load Drivers

- PMIC - Power Management - Specialized

- PMIC - Power Over Ethernet (PoE) Controllers

- PMIC - Power Supply Controllers, Monitors

- PMIC - RMS to DC Converters

- PMIC - Supervisors

- PMIC - Thermal Management

- PMIC - V/F and F/V Converters

- PMIC - Voltage Reference

- PMIC - Voltage Regulators - DC DC Switching Controllers

- PMIC - Voltage Regulators - DC DC Switching Regulators

- PMIC - Voltage Regulators - Linear

- PMIC - Voltage Regulators - Linear + Switching

- PMIC - Voltage Regulators - Linear Regulator Controllers

- PMIC - Voltage Regulators - Special Purpose

- Specialized ICs

- Isolators

- Relays

-

RF/IF and RFID

- Attenuators

- Balun

- RF Accessories

- RF Amplifiers

- RF Antennas

- RF Demodulators

- RF Detectors

- RF Diplexers

- RF Directional Coupler

- RF Evaluation and Development Kits, Boards

- RF Front End (LNA + PA)

- RF Misc ICs and Modules

- RF Mixers

- RF Modulators

- RF Power Controller ICs

- RF Power Dividers/Splitters

- RF Receiver, Transmitter, and Transceiver Finished Units

- RF Receivers

- RF Shields

- RF Switches

- RF Transceiver ICs

- RF Transceiver Modules

- RF Transmitters

- RFI and EMI - Contacts, Fingerstock and Gaskets

- RFI and EMI - Shielding and Absorbing Materials

- RFID Accessories

- RFID Antennas

- RFID Evaluation and Development Kits, Boards

- RFID Reader Modules

- RFID Transponders, Tags

- RFID, RF Access, Monitoring ICs

- RF Circulators and Isolators

-

Sensors, Transducers

- Accessories

- Amplifiers

- Capacitive Touch Sensors, Proximity Sensor ICs

- Color Sensors

- Current Transducers

- Dust Sensors

- Encoders

- Flex Sensors

- Float, Level Sensors

- Flow Sensors

- Force Sensors

- Gas Sensors

- Humidity, Moisture Sensors

- Image Sensors, Camera

- IrDA Transceiver Modules

- Magnetic Sensors - Compass, Magnetic Field (Modules)

- Magnetic Sensors - Linear, Compass (ICs)

- Magnetic Sensors - Position, Proximity, Speed (Modules)

- Magnetic Sensors - Switches (Solid State)

- Magnets - Multi Purpose

- Magnets - Sensor Matched

- Motion Sensors - Accelerometers

- Motion Sensors - Gyroscopes

- Motion Sensors - IMUs (Inertial Measurement Units)

- Motion Sensors - Inclinometers

- Motion Sensors - Optical

- Motion Sensors - Tilt Switches

- Motion Sensors - Vibration

- Multifunction

- Optical Sensors - Ambient Light, IR, UV Sensors

- Optical Sensors - Distance Measuring

- Optical Sensors - Mouse

- Optical Sensors - Photo Detectors - CdS Cells

- Optical Sensors - Photo Detectors - Logic Output

- Optical Sensors - Photo Detectors - Remote Receiver

- Optical Sensors - Photodiodes

- Optical Sensors - Photoelectric, Industrial

- Optical Sensors - Photointerrupters - Slot Type - Logic Output

- Optical Sensors - Photointerrupters - Slot Type - Transistor Output

- Optical Sensors - Phototransistors

- Optical Sensors - Reflective - Analog Output

- Optical Sensors - Reflective - Logic Output

- Position Sensors - Angle, Linear Position Measuring

- Pressure Sensors, Transducers

- Proximity Sensors

- Proximity/Occupancy Sensors - Finished Units

- Sensor Cable - Accessories

- Sensor Cable - Assemblies

- Sensor Interface - Junction Blocks

- Shock Sensors

- Solar Cells

- Specialized Sensors

- Strain Gauges

- Temperature Sensors - Analog and Digital Output

- Temperature Sensors - NTC Thermistors

- Temperature Sensors - PTC Thermistors

- Temperature Sensors - RTD (Resistance Temperature Detector)

- Temperature Sensors - Thermocouple, Temperature Probes

- Temperature Sensors - Thermostats - Mechanical

- Temperature Sensors - Thermostats - Solid State

- Ultrasonic Receivers, Transmitters

- Camera Modules

- LVDT Transducers (Linear Variable Differential Transformer)

- Optical Sensors - Photonics - Counters, Detectors, SPCM (Single Photon Counting Module)

- Touch Sensors

-

Circuit Protection

- Accessories

- Circuit Breakers

- Electrical, Specialty Fuses

- Fuseholders

- Fuses

- Gas Discharge Tube Arresters (GDT)

- Ground Fault Circuit Interrupter (GFCI)

- Inrush Current Limiters (ICL)

- Lighting Protection

- PTC Resettable Fuses

- Surge Suppression ICs

- TVS - Diodes

- TVS - Mixed Technology

- TVS - Surge Protection Devices (SPDs)

- TVS - Thyristors

- TVS - Varistors, MOVs

- Thermal Cutoffs (Thermal Fuses)

-

Connectors, Interconnects

- Backplane Connectors - ARINC Inserts

- Backplane Connectors - ARINC

- Backplane Connectors - Accessories

- Backplane Connectors - Contacts

- Backplane Connectors - DIN 41612

- Backplane Connectors - Hard Metric, Standard

- Backplane Connectors - Housings

- Backplane Connectors - Specialized

- Banana and Tip Connectors - Accessories

- Banana and Tip Connectors - Adapters

- Banana and Tip Connectors - Binding Posts

- Banana and Tip Connectors - Jacks, Plugs

- Barrel - Accessories

- Barrel - Adapters

- Barrel - Audio Connectors

- Barrel - Power Connectors

- Between Series Adapters

- Blade Type Power Connectors - Accessories

- Blade Type Power Connectors - Contacts

- Blade Type Power Connectors - Housings

- Blade Type Power Connectors

- Card Edge Connectors - Accessories

- Card Edge Connectors - Adapters

- Card Edge Connectors - Contacts

- Card Edge Connectors - Edgeboard Connectors

- Card Edge Connectors - Housings

- Circular Connectors - Accessories

- Circular Connectors - Adapters

- Circular Connectors - Backshells and Cable Clamps

- Circular Connectors - Contacts

- Circular Connectors - Housings

- Circular Connectors

- Coaxial Connectors (RF) - Accessories

- Coaxial Connectors (RF) - Adapters

- Coaxial Connectors (RF) - Contacts

- Coaxial Connectors (RF) - Terminators

- Coaxial Connectors (RF)

- Contacts - Leadframe

- Contacts - Multi Purpose

- Contacts, Spring Loaded (Pogo Pins), and Pressure

- D-Shaped Connectors - Centronics

- D-Sub Connectors

- D-Sub, D-Shaped Connectors - Accessories - Jackscrews

- D-Sub, D-Shaped Connectors - Accessories

- D-Sub, D-Shaped Connectors - Adapters

- D-Sub, D-Shaped Connectors - Backshells, Hoods

- D-Sub, D-Shaped Connectors - Contacts

- D-Sub, D-Shaped Connectors - Housings

- D-Sub, D-Shaped Connectors - Terminators

- FFC, FPC (Flat Flexible) Connectors - Accessories

- FFC, FPC (Flat Flexible) Connectors - Contacts

- FFC, FPC (Flat Flexible) Connectors - Housings

- FFC, FPC (Flat Flexible) Connectors

- Fiber Optic Connectors - Accessories

- Fiber Optic Connectors - Adapters

- Fiber Optic Connectors - Housings

- Fiber Optic Connectors

- Heavy Duty Connectors - Accessories

- Heavy Duty Connectors - Assemblies

- Heavy Duty Connectors - Contacts

- Heavy Duty Connectors - Frames

- Heavy Duty Connectors - Housings, Hoods, Bases

- Heavy Duty Connectors - Inserts, Modules

- Keystone - Accessories

- Keystone - Faceplates, Frames

- Keystone - Inserts

- LGH Connectors

- Memory Connectors - Accessories

- Memory Connectors - Inline Module Sockets

- Memory Connectors - PC Card Sockets

- Memory Connectors - PC Cards - Adapters

- Modular Connectors - Accessories

- Modular Connectors - Adapters

- Modular Connectors - Jacks With Magnetics

- Modular Connectors - Jacks

- Modular Connectors - Plug Housings

- Modular Connectors - Plugs

- Modular Connectors - Wiring Blocks - Accessories

- Modular Connectors - Wiring Blocks

- Photovoltaic (Solar Panel) Connectors - Accessories

- Photovoltaic (Solar Panel) Connectors - Contacts

- Photovoltaic (Solar Panel) Connectors

- Pluggable Connectors - Accessories

- Pluggable Connectors

- Power Entry Connectors - Accessories

- Power Entry Connectors - Inlets, Outlets, Modules

- Rectangular Connectors - Accessories

- Rectangular Connectors - Adapters

- Rectangular Connectors - Arrays, Edge Type, Mezzanine (Board to Board)

- Rectangular Connectors - Board In, Direct Wire to Board

- Rectangular Connectors - Board Spacers, Stackers (Board to Board)

- Rectangular Connectors - Contacts

- Rectangular Connectors - Free Hanging, Panel Mount

- Rectangular Connectors - Headers, Male Pins

- Rectangular Connectors - Headers, Receptacles, Female Sockets

- Rectangular Connectors - Headers, Specialty Pin

- Rectangular Connectors - Housings

- Rectangular Connectors - Spring Loaded

- Shunts, Jumpers

- Sockets for ICs, Transistors - Accessories

- Sockets for ICs, Transistors - Adapters

- Sockets for ICs, Transistors

- Solid State Lighting Connectors - Accessories

- Solid State Lighting Connectors - Contacts

- Solid State Lighting Connectors

- Terminal Blocks - Accessories - Jumpers

- Terminal Blocks - Accessories - Marker Strips

- Terminal Blocks - Accessories - Wire Ferrules

- Terminal Blocks - Accessories

- Terminal Blocks - Adapters

- Terminal Blocks - Barrier Blocks

- Terminal Blocks - Contacts

- Terminal Blocks - Din Rail, Channel

- Terminal Blocks - Headers, Plugs and Sockets

- Terminal Blocks - Interface Modules

- Terminal Blocks - Panel Mount

- Terminal Blocks - Power Distribution

- Terminal Blocks - Specialized

- Terminal Blocks - Wire to Board

- Terminal Junction Systems

- Terminal Strips and Turret Boards

- Terminals - Accessories

- Terminals - Adapters

- Terminals - Barrel, Bullet Connectors

- Terminals - Foil Connectors

- Terminals - Housings, Boots

- Terminals - Knife Connectors

- Terminals - Magnetic Wire Connectors

- Terminals - PC Pin Receptacles, Socket Connectors

- Terminals - PC Pin, Single Post Connectors

- Terminals - Quick Connects, Quick Disconnect Connectors

- Terminals - Rectangular Connectors

- Terminals - Ring Connectors

- Terminals - Screw Connectors

- Terminals - Solder Lug Connectors

- Terminals - Spade Connectors

- Terminals - Specialized Connectors

- Terminals - Turret Connectors

- Terminals - Wire Pin Connectors

- Terminals - Wire Splice Connectors

- Terminals - Wire to Board Connectors

- USB, DVI, HDMI Connectors - Accessories

- USB, DVI, HDMI Connectors - Adapters

- USB, DVI, HDMI Connectors

- Crystals, Oscillators, Resonators

-

Development Boards, Kits, Programmers

- Accessories

- Evaluation Boards - Analog to Digital Converters (ADCs)

- Evaluation Boards - Audio Amplifiers

- Evaluation Boards - DC/DC & AC/DC (Off-Line) SMPS

- Evaluation Boards - Digital to Analog Converters (DACs)

- Evaluation Boards - Embedded - Complex Logic (FPGA, CPLD)

- Evaluation Boards - Embedded - MCU, DSP

- Evaluation Boards - Expansion Boards, Daughter Cards

- Evaluation Boards - LED Drivers

- Evaluation Boards - Linear Voltage Regulators

- Evaluation Boards - Op Amps

- Evaluation Boards - Sensors

- Evaluation and Demonstration Boards and Kits

- Programmers, Emulators, and Debuggers

- Programming Adapters, Sockets

- Software, Services

- UV Erasers

- Filters

- Memory Cards, Modules

- Potentiometers, Variable Resistors

- Power Supplies - Board Mount

- Power Supplies - External/Internal (Off-Board)

- Resistors

ON Semiconductor Corporation (ON) Downgraded by Zacks Investment Research

![]() ON Semiconductor Corporation (NASDAQ:ON) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a report released on Tuesday.

ON Semiconductor Corporation (NASDAQ:ON) was downgraded by Zacks Investment Research from a “buy” rating to a “hold” rating in a report released on Tuesday.

According to Zacks, “ON Semi's Fairchild acquisition has helped the company to grab a dominant position in the power semiconductor market with a planned focus on smartphone, automotive and industrial end markets. Additionally, higher synergies from the Fairchild acquisition along with improving operating leverage will boost profitability. We note that automotive present significant growth prospects given strong demand for ADAS related applications. Moreover, the company’s plan to sell products (like power modules) from consumer end-market to industrial applications end-market will boost margins and revenues in the long term. Meanwhile, estimates have been stable lately ahead of the company's Q2 earnings release. The company has mixed record of earnings surprises in recent quarters. However, On Semi has underperformed the broader market on a year-to-date basis, primarily due to modest results. Moreover, leveraged balance sheet remains a concern.”

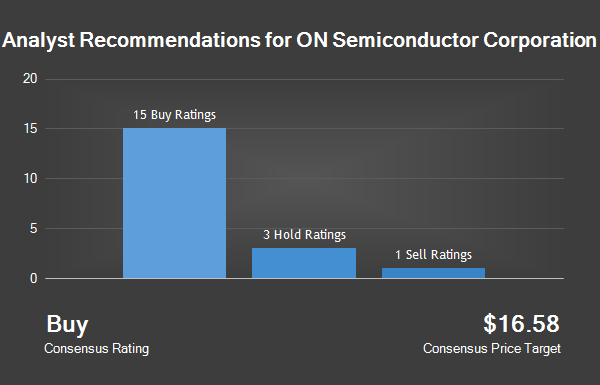

Other equities research analysts also recently issued research reports about the company. B. Riley reissued a “buy” rating and set a $18.00 price objective on shares of ON Semiconductor Corporation in a report on Monday, June 12th. Raymond James Financial, Inc. started coverage on ON Semiconductor Corporation in a research report on Friday, June 16th. They set an “outperform” rating and a $19.00 target price for the company. Mizuho raised their target price on ON Semiconductor Corporation from $17.00 to $18.00 and gave the stock a “buy” rating in a research report on Monday, March 13th. Robert W. Baird reaffirmed an “outperform” rating and set a $21.00 target price on shares of ON Semiconductor Corporation in a research report on Monday, March 13th. Finally, Credit Suisse Group lowered ON Semiconductor Corporation from a “neutral” rating to an “underperform” rating and lowered their target price for the stock from $17.50 to $13.50 in a research report on Tuesday, April 11th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating, fifteen have given a buy rating and one has given a strong buy rating to the company’s stock. ON Semiconductor Corporation currently has an average rating of “Buy” and a consensus price target of $16.40.

Shares of ON Semiconductor Corporation (NASDAQ ON) traded up 0.55% during mid-day trading on Tuesday, hitting $14.53. The stock had a trading volume of 1,746,928 shares. The stock has a market capitalization of $6.11 billion, a P/E ratio of 27.94 and a beta of 1.97. ON Semiconductor Corporation has a 52 week low of $8.72 and a 52 week high of $16.93. The stock has a 50 day moving average of $15.43 and a 200-day moving average of $14.57.

ILLEGAL ACTIVITY WARNING: “ON Semiconductor Corporation (ON) Downgraded by Zacks Investment Research” was published by American Banking News and is the sole property of of American Banking News. If you are reading this piece on another website, it was illegally stolen and reposted in violation of United States & international copyright and trademark law. The correct version of this piece can be viewed at https://www.americanbankingnews.com/2017/07/11/on-semiconductor-corporation-on-downgraded-by-zacks-investment-research.html.

In other news, EVP Robert A. Klosterboer sold 10,000 shares of ON Semiconductor Corporation stock in a transaction on Thursday, May 4th. The shares were sold at an average price of $14.04, for a total transaction of $140,400.00. Following the transaction, the executive vice president now owns 334,320 shares in the company, valued at approximately $4,693,852.80. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, EVP William Hall sold 41,364 shares of ON Semiconductor Corporation stock in a transaction on Monday, May 15th. The stock was sold at an average price of $15.30, for a total transaction of $632,869.20. The disclosure for this sale can be found here. Insiders sold 134,690 shares of company stock worth $2,094,440 in the last 90 days. 1.60% of the stock is currently owned by corporate insiders.

Hedge funds have recently made changes to their positions in the stock. Beacon Capital Management purchased a new stake in shares of ON Semiconductor Corporation during the fourth quarter valued at approximately $0. Ifrah Financial Services Inc. increased its stake in shares of ON Semiconductor Corporation by 1.2% in the second quarter. Ifrah Financial Services Inc. now owns 20,919 shares of the semiconductor company’s stock worth $185,000 after buying an additional 257 shares in the last quarter. Emerald Mutual Fund Advisers Trust increased its stake in shares of ON Semiconductor Corporation by 2.5% in the second quarter. Emerald Mutual Fund Advisers Trust now owns 14,642 shares of the semiconductor company’s stock worth $129,000 after buying an additional 356 shares in the last quarter. Cadence Capital Management LLC increased its stake in shares of ON Semiconductor Corporation by 2.9% in the fourth quarter. Cadence Capital Management LLC now owns 13,366 shares of the semiconductor company’s stock worth $171,000 after buying an additional 381 shares in the last quarter. Finally, Amalgamated Bank increased its stake in shares of ON Semiconductor Corporation by 0.7% in the first quarter. Amalgamated Bank now owns 59,332 shares of the semiconductor company’s stock worth $919,000 after buying an additional 393 shares in the last quarter. Hedge funds and other institutional investors own 96.26% of the company’s stock.

About ON Semiconductor Corporation

ON Semiconductor Corporation offers a portfolio of sensors, power management, connectivity, custom and system on chip (SoC), analog, logic, timing, and discrete devices. The Company’s segments include Power Solutions Group, Analog Solutions Group and Image Sensor Group. The Power Solutions Group offers a range of discrete, module and integrated semiconductor products.

Get a free copy of the Zacks research report on ON Semiconductor Corporation (ON)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Receive News & Ratings for ON Semiconductor Corporation Daily - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings for ON Semiconductor Corporation and related companies with MarketBeat.com's FREE daily email newsletter.

Related Posts

Comments (4)

-

Jessica MooreThis article about electronic components is well-written and informative. It covers a wide range of topics and provides valuable insights into the world of electronics. I found the explanations to be clear and easy to understand, even for someone with limited technical knowledge.November 30, 2019

Jessica MooreThis article about electronic components is well-written and informative. It covers a wide range of topics and provides valuable insights into the world of electronics. I found the explanations to be clear and easy to understand, even for someone with limited technical knowledge.November 30, 2019-

Adam TaylorI also enjoyed reading this article. It's great to see such clear explanations of complex topics. Looking forward to reading more from this author in the future.December 5, 2019

Adam TaylorI also enjoyed reading this article. It's great to see such clear explanations of complex topics. Looking forward to reading more from this author in the future.December 5, 2019

-

-

Ryan FordI completely agree with the previous reviewer. This article is an excellent resource for anyone interested in learning about electronic components. I particularly appreciated the section on common types of resistors and how to read their values. Keep up the good work!December 5, 2020

Ryan FordI completely agree with the previous reviewer. This article is an excellent resource for anyone interested in learning about electronic components. I particularly appreciated the section on common types of resistors and how to read their values. Keep up the good work!December 5, 2020

Write A Comment

Popular News

-

Vishay Intertechnology, Inc. (NYSE:VSH) has been assigned a consensus rating of ...Jul 13, 2017

-

Vishay Intertechnology, a Rare Tech Stock on SaleThe valuation of technology sto...Apr 24, 2017

-

Digital and memory ICs constitute about two-thirds of today's roughly $320 billi...Jul 14, 2017

-

Integrated Circuit,Diodes, Transistors,Semiconductors,Capacitance,resistance,Tan...Sep 5, 2017

-

HELLA Aglaia and NXP open visual platform for automated driving safety....Sep 13, 2017

.jpg)